Retail sales in Great Britain hit highest since 2022, boosted by gold demand; Trump terminates US-Canada trade talks – business live | Business

Introduction: Retail sales rise, lifted by warm weather and gold demand

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

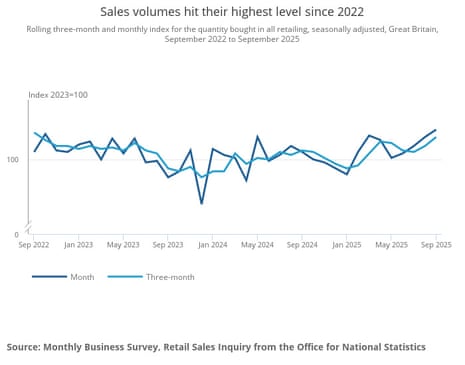

Retail sales across Great Britain have risen, in a sign that consumer spending is holding up despite the pressure from inflation.

New data from the Office for National Statistics this morning shows that retail sales volumes increased by 0.5% in September, and were 1.5% higher than a year earlier. Economists had expected a 0.2% monthly drop.

The ONS reports that sales grew strongly at non-food stores, including computer and telecommunications retailers.

A “notable contributor to this rise was online jewellers reporting a strong demand for gold”, the ONS says – as some consumers have flocked to bullion as its price rose to record highs this year.

Overall, sales volumes hit to their highest level since 2022 in September – although they are still 1.6% below their levels in February 2020 before the first Covid-19 lockdown.

Sales volumes are also their highest since 2022 over the last three months. In the quarter to September, sales volumes rose by 0.9% with the hot weather in July and August boosting clothing sales.

ONS senior statistician Hannah Finselbach says:

“Retail sales rose quite strongly in the latest quarter and were at their highest level since summer 2022. Although food stores saw very little growth, good weather in July and August boosted sales of clothing, while online retailing also did well.

“Retail sales also grew over the month of September, with tech stores seeing a notable rise in sales, while online jewellers reported strong demand for gold.”

Also coming up today

Hopes of a breakthrough in US-Canada relations have taken a blow, after Donald Trump has said he is ending “all trade negotiations” with his northern neighbour after the release of a television ad opposing US tariffs.

The US president accused Canada of “egregious behavior” aimed at influencing US court decisions.

And after weeks of disruption caused by the government shutdown, investors will finally be shown some official US economic data today!

The Bureau of Labor Statistics is expected to publish its September inflation report today, which is expected to show the CPI index rose by around 3.1% over the last year, above the Federal Reserve’s 2% target.

The agenda

-

7am BST: Great Britain retail sales report

-

9am BST: Flash eurozone PMI report

-

9.30am BST: Flash UK PMI report

-

1.30pm BST: US inflation report for September

-

3pm BST: University of Michigan US consumer confidence report

Key events

Record weekly inflow into gold funds

UK shoppers aren’t the only people snapping up gold.

Gold funds received their largest weekly inflow on record in the week to Wednesday, Bank of America Global Research have reported.

Gold funds saw inflows of $8.7bn in the week BofA said, putting the inflows over the last four months at $50bn.

Gold hit a record high of $4,381.21 per ounce on Monday, more than 60% higher than at the start of this year, before dropping back.

Right now, it’s changing hands at $4,091.20 per ounce.

NatWest lifts FTSE 100 to new record high

Britain’s blue-chip stock index has hit a fresh record high in early trading.

The FTSE 100 index has risen over Thursday’s record peak of 9594 points, and just touched 9595.72.

NatWest bank is leading the risers, up around 5% after reporting a jump in profits this morning. It’s followed by DIY chain Kingfisher (+2.7%)

Back in the world of the trade wars, Swiss President Karin Keller-Sutter has declined to say whether her country could strike a deal on tariffs with U.S. President Donald Trump this year.

“It’s not possible to forecast,” Keller-Sutter said in a Tages-Anzeiger newspaper interview published on Friday when asked about the possibility of an agreement in 2025. “Everything depends on whether the U.S. president gives the green light or not.”

Relations between the two sides are strained, after Trump imposed 39% tariffs on Switzerland in August, a serious threat to Swiss exports to the US.

NatWest profits jump 30% as lending increases

Kalyeena Makortoff

NatWest has reported very strong numbers this morning, with pre-tax Q3 profit up 30% – a stark contrast to its rival Lloyds Banking Group which reported a 36% drop yesterday.

A significant difference between them, of course, is NatWest’s lack of exposure to the car loans commissions scandal, unlike Lloyds which is at the heart of the storm, having put aside another £800m to cover customer compensation in the last quarter.

Meanwhile, NatWest has been able to charge ahead, with broad-based increase in customer lending to both consumers and businesses helping to push its pre-tax profits up 30.4% to £2.18bn in the three months to the end of September. That is up from £1.67bn during the same period last year.

It also benefited from a drop in impairment charges to £153m compared to £245m last year, when it took a charge following its acquisition of Sainsbury’s Bank.

NatWest has been shedding jobs, around 600 over the past 12 months, 100 of which were in the last quarter alone. “Our focus remains on driving cost savings to create capacity for further investment to accelerate our bank-wide simplification,” the bank says.

However, that didn’t provide a major boost to the bottom line, given overall, operating expenses were £171m higher since last year.

But the once bailed out bank – which shed its final UK government stake earlier this year – said it was now upping its full year profitability and income guidance. It now expects income to come in at £16.3bn (excluding notable items) for 2025, solidifying previous forecasts for income greater than £16bn.

CEO Paul Thwaite said:

“As a result of our consistent delivery and capital generation, we have upgraded our income and returns guidance for 2025 and are well placed to support our customers, invest for the future and deliver returns to our shareholders.”

Retail sales: What the experts say

UK economists were surprised to learn that retail sales volumes rose by 0.5% across Great Britain in September, as the consensus was for a 0.2% fall.

Oliver Vernon-Harcourt, head of retail at Deloitte, says:

“The unexpected rise in retail sales in September will be a positive boost for retailers, particularly when combined with the uplift of 0.9% in sales volumes in the three months to September.

“There are signs that big ticket purchases are back on the cards for some, with an uptick in the sale of tech like computers and phones, as well as household goods and furniture. This indicates that budgeting for major purchases is becoming more of a priority for consumers.

Alex Kerr, UK economist at Capital Economics, doubts that this strength will be sustainable, given weak employment, high inflation and tax rises on the horizon:

The resilience of the retail sector was fairly broad based, with sales rising in four of the seven sub sectors, with household goods and other stores posting healthy 1.2% m/m and 2.1% m/m gains, driven by strong sales of computers and mobile devices. Online sales rose by 1.5% m/m with the press release citing strong demand for gold at online jewellers, perhaps fuelled by the surge in gold prices this year.

Elsewhere, despite the decline in food CPI inflation in September, sales at food stores fell back by 0.1% m/m, underlining that households probably care more about the sustained increase in the level of food prices over the last few years.

Kien Tan, senior retail advisor at PwC UK, says retail sales have continued their slowly improving trend over the last three months:

“The autumnal weather certainly helped fashion sales, with clothing retailers continuing their run of outperformance and encouraging shoppers to refresh their wardrobes with the newest season trends.

“However, autumn showers also discouraged shoppers from visiting physical stores, as high street footfall fell and the proportion of sales online increased to 28%, which is the highest penetration of online retail since the end of the pandemic.

Canadian dollar weakens as Trump terminates trade talks

The Canadian dollar has weakened slightly after Donald Trump blew up the US-Canada trade talks overnight.

The Canadian currency has dropped by 0.2%, to 1.4018 to the US$.

In a post on his Truth Social site, Trump accused Canada of fraudulently using a “FAKE” advertisement featuring Ronald Reagan speaking negatively about tariffs, to sway a decision from America’s highest federal court on the legality of US levies on imports.

Trump declared:

They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A. Based on their egregious behavior, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED.

Introduction: Retail sales rise, lifted by warm weather and gold demand

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Retail sales across Great Britain have risen, in a sign that consumer spending is holding up despite the pressure from inflation.

New data from the Office for National Statistics this morning shows that retail sales volumes increased by 0.5% in September, and were 1.5% higher than a year earlier. Economists had expected a 0.2% monthly drop.

The ONS reports that sales grew strongly at non-food stores, including computer and telecommunications retailers.

A “notable contributor to this rise was online jewellers reporting a strong demand for gold”, the ONS says – as some consumers have flocked to bullion as its price rose to record highs this year.

Overall, sales volumes hit to their highest level since 2022 in September – although they are still 1.6% below their levels in February 2020 before the first Covid-19 lockdown.

Sales volumes are also their highest since 2022 over the last three months. In the quarter to September, sales volumes rose by 0.9% with the hot weather in July and August boosting clothing sales.

ONS senior statistician Hannah Finselbach says:

“Retail sales rose quite strongly in the latest quarter and were at their highest level since summer 2022. Although food stores saw very little growth, good weather in July and August boosted sales of clothing, while online retailing also did well.

“Retail sales also grew over the month of September, with tech stores seeing a notable rise in sales, while online jewellers reported strong demand for gold.”

Also coming up today

Hopes of a breakthrough in US-Canada relations have taken a blow, after Donald Trump has said he is ending “all trade negotiations” with his northern neighbour after the release of a television ad opposing US tariffs.

The US president accused Canada of “egregious behavior” aimed at influencing US court decisions.

And after weeks of disruption caused by the government shutdown, investors will finally be shown some official US economic data today!

The Bureau of Labor Statistics is expected to publish its September inflation report today, which is expected to show the CPI index rose by around 3.1% over the last year, above the Federal Reserve’s 2% target.

The agenda

-

7am BST: Great Britain retail sales report

-

9am BST: Flash eurozone PMI report

-

9.30am BST: Flash UK PMI report

-

1.30pm BST: US inflation report for September

-

3pm BST: University of Michigan US consumer confidence report